"Investing for impact is not just a feel-good decision; it’s a smart and savvy one too. Our portfolio not only drives positive change but also taps into fast-growing markets and industries prioritizing sustainability, social responsibility and innovation. We are proud our investments make a difference in areas such as renewable energy, carbon tech, financial inclusion, low-cost healthcare and education while still delivering returns that compare favorably to traditional investments. Our impact investing portfolio combines performance, purpose and passion, making it a winning choice for those driven by a desire for impact.”

Introduction

Fabio Kestenbaum

Chief Executive at Positive Ventures

Impact overview

Total Lives impacted:

(cumulative)

10% Growth (YoY)

3,1M

2021

3,4M

2022

Total Revenue:

60% Growth (YoY)

$ 50M

2021

$ 80M

2022

Portfolio market cap:

135% Growth (YoY)

$ 391M

2021

$ 920M

2022

Total catalytic capital AUM:

+$ 40M

Capital allocated per Impact Themes:

Planet Prosperity: 27%

.png)

Social Resilience: 73%

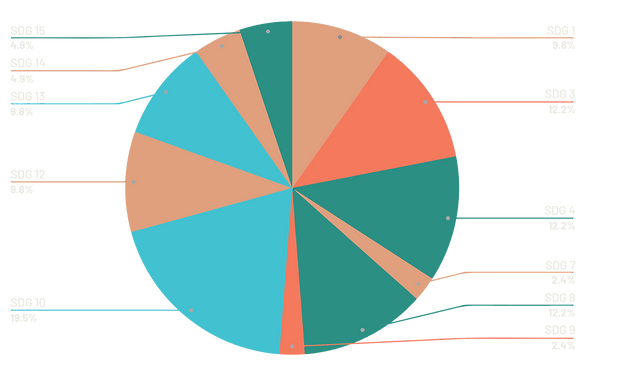

SGDs Positive Ventures:

% of investments addressing each SDG

Investments Locations

We are currently making a positive impact in 22 countries:

Third party evaluation:

One portfolio company became a B Corp: Neomed

28% of our portfolio companies are B Certified.

Partnerships to improve and evaluate impact:

2 investees had an impact report done by independent external evaluators in 2022. Provi by Yunus Social Business and Slang by 60Decibels.

Workforce Women diversity:

1,4k

Total number of employees in our active portfolio

57%

are women

(according to World Bank data, the Latin American average is 41%)

80%

of our active portfolio have women in leadership

positions

53%

of our active portfolio have at least one female founder

(according to International Labor Organization data, the Latin American average is 7%)

Gender

Lens:

The 2X Challenge was launched at the G7 Summit 2018 as a bold commitment to inspire DFIs/IFIs and the broader private sector to invest in the world’s women.

Positive Ventures and 80% of our portfolio companies meet the standards of the 2X Challenge.

Beneficiaries:

75%

of the beneficiaries (1) come from low-income population (2)

(1) This is an estimate based on the portfolio companies that apply to the referring data

(2) Class C, D & E in Brazil

Portfolio Impact performance overview:

1,8k

Schools

485k

Students

660k

Tons of compensated solid waste

2,3M

Job opportunities created

4,4M

Exams

1,9M

Carbon Credits (booked)

“I learned to face challenges and trust that things will work out if we do your best. The best part is knowing that their talent is being used to improve the situation of the most vulnerable people and the environment, which they help to protect.”

“Empathy, care, quick and specialized service, from the attendants on Whatsapp to the doctor who assisted me, all attentive and willing to help me in everything.”

“I started the course as a janitor, I left as a Data Science intern, I managed to fulfill the promise I had made to myself to enter the technology sector before the pandemic ended. This life-changing opportunity has changed not only my professional life, but changed my mind as well, the way I see problems and challenges. Everything became more interesting.”

“Now it is easier to understand conversations in English and reading articles and books is more accessible.”

“I never thought I would sell anything in my life and, because of the whole team, they taught me how to sell and deliver to people in a very short time. I feel happy and I don't think about leaving, because I feel part of the community.”

“Despite having taken several courses and always looking to develop myself, I couldn't find a job. They have changed that! I am going to work at a company I admire a lot and I will get there much more prepared for the challenges I may encounter."

Solving real problems for a better planet

Solving real problems for a better planet

Snapshot of all the user's feedback

Company Name:

Investment vehicle:

Eureciclo

Legacy

Founded:

Year of Investment:

2016

2017

Headquarters & Global Locations:

Brazil, Chile and France

Website:

Eureciclo.com.br

Impact Theme:

Planet Prosperity

SDGs:

(8) Decent Work and Economic Growth, (11) Sustainable Cities and Communities, (12) Responsible Consumption and Production.

Founder:

Impact Vision:

A world where waste is transformed into valuable resources through incentives for recycling and reusing, hence reducing pollution and environmental harm caused by careless disposal.

Why we invested

Human activity results in the annual production of 400 million tons of plastic waste, the overwhelming majority of which (98%) comes from fossil fuel resources. Unfortunately, 85% of plastic worldwide is disposed improperly, ending up in landfills or other unsuitable locations.

Moreover, the global recycling ratio for plastic waste is an abysmal 10%, which amounts to a staggering annualy loss of plastic packaging waste ranging from U$80B to 120 billion dollars. As a result, nations across the world have enacted new regulations to increase recycling rates. For example, the European Union recently implemented a law that requires countries to recycle at least 55% of municipal waste by 2025, 60% by 2030 and 65% by 2035. In addition, a new mandatory law obligates the separation of bio waste and calls for stricter regulations to make producers purchase recyclable keys.

In Brazil, regulatory law PNRS requires companies to recycle 22% of their packaging waste and increase that percentage to 45% by 2031. To address this issue, Eureciclo, the largest validator of corporate packaging processes in Latin America, has developed a block chain-based technology that provides transparency and reliability to track recycling and offsets post-consumption waste through their marketplace for recycling credits exchange. This solution has the added benefit of creating new jobs and ensuring proper payment for the service recyclers provide to society.

“We have begun to pave the way for encouraging recycling and have taken a significant step that puts us on the path to increasing recycling rates, which could reach up to 800,000 tons by 2023.”

Thiago Carvalho Pinto

Eureciclo's co founder & chief executive

“I learned to face challenges and believe that things will work out if we do our best. I joined when they were not even the selo eureciclo and the impact on cooperatives was only crawling. Since then, a lot of code has been written, a lot of product definition and the amazing people who came along the way to help. The best part is knowing their talent is being used to improve the situation of the most vulnerable people and the environment, which they help to protect.”

Beneficiary

Impact Perfomances KPI's

Impact data: Dec/2022

7k

Clients

R$40,9M

Total Rebound

R$8,1M

Rebound for recyclers

660k

Compensated Tons

23

States in Brazil

Positive Notes

The recycling credit market in Brazil underwent significant changes due to new legislation. As previously mentioned, the PNRS law, implemented in 2010, served as the foundation for subsequent decrees and regulations. This law has a federal scope and outlines the requirements (e.g. recycle 22% of packaging by 2020 and 45% by 2031). However, it does not provide guidance on how to meet these targets.

That is where the Recicla+ comes in. The new federal decree brings one of the possible ways of complying with the PNRS law via the purchase of recycling credits – which is exactly the service, Eureciclo provides in Brazil. This is a significant milestone for the recycling credit industry because it brings much-needed regulation and oversight to an emerging industry. Without this framework, there would be little incentive for companies to comply with the PNRS law.

The reverse logistics companies, like Eureciclo, had to create a managing entity (Instituto Giro), an institute that represents the company to the government. Instituto Giro is responsible for the emission of certificates and develops a report of the companies following the PNRS law.

Eureciclo is also spearheading a new project in partnership with Veolia Brazil to boost reverse logistics in Brazil with a team of specialists to work on developing innovative solutions on several fronts. The project started in the ‘Centros de Gerenciamento de Resíduos’ (CGRs) at Santa Catarina e São Paulo, with an estimated potential of recovering 180k tons per year of recyclable waste.

Company Name:

Investment vehicle:

Favo

Impact Tech I

Founded:

Year of Investment:

2019

2021

Headquarters & Global Locations:

Peru

Website:

Mercadofavo.com

Impact Theme:

Social Resilience

SDGs:

(1) No Poverty, (5) Gender Equality, (8) Decent Work and Economic Growth, (10) Reduced Inequalities

Founders:

Impact Vision:

A society where marginalized communities have access to affordable and convenient goods, supporting local economies and entrepreneurship while promoting economic development.

Why we invested

As one of the many bifurcations due to a high 10% food inflation, hunger in Latin America and the Caribbean has reached its highest levels since the beginning of the 21st century, resulting in 60 million malnourished people and contributing to a 9.96% unemployment rate. Brazilian families spend up to 22% of their budget on groceries. While in Peru, households spend a staggering 53% of their income on food and non-alcoholic beverages. Furthermore, a research conducted by Real-Time Big Data Institute reveals 48% of Brazilians are looking for new revenue streams mainly to afford food & groceries.

Favo has cracked the e-commerce LATAM market through the community-buying model, a U$14B market in China that allows communities to purchase groceries at lower prices. Local entrepreneurs intermediate the delivery of the goods and receive a commission for each purchase – generating an additional source of income for that worker. Additionally, Favo supports local community members in developing their online stores through its SKU Management, resulting in the creation of new revenue streams for over 3,000 people. Favo's platform offers a diverse selection of over 3,000 products, providing customers with a convenient and affordable shopping experience.

"This is Favo's social role, which is at the essence of the startup: empowering communities by creating opportunities in an increasingly scarce work context.”

Alejandro Ponce

Favo’s founder & CEO

“Favo taught me many things, I never thought I would sell anything in my life and, because of the whole team, they taught me how to sell and deliver to people in a very short time. I feel happy and I don't think about leaving, because I feel part of the community.”

Jaenette

English teacher and Favo entrepreneur

Impact Perfomances KPI's

Impact data: Dec/2022

1,6M

Orders

Only in Peru

+ 30k

Entrepreneurs impacted

80%

Women’s entrepreneurs (avg.)

Positive Notes

Favo underwent a significant strategic shift following a market turnaround, temporarily suspending its Brazilian operations and focusing exclusively on Peru. Despite this, their commitment to improving the lives of low-income populatins in Latin America has remained unchanged.

Peru has experienced a high level of unemployment in recent years, reaching a peak of 13.5% in 2020 exacerbated by the COVID-19 pandemic. The medical outbreak resulted in high unemployment in Peru and vulnerable populations, such as informal workers, have withstood the worst of the pandemic's impact. Additionally, the country faces long-standing structural issues that contribute to high levels of unemployment, such as a lack of job opportunities in specific regions and a mismatch between the skills of workers and the demands of the labor market.

In 2022, Favo impacted 14,800 micro-entrepreneurs, a mere 28% have completed higher education, which is why they receive sales and personal finance training and 50% had no source of income other than Favo. Notably, entrepreneurs who choose Favo as a full-time job can earn more than 50% of their household income.

Therefore, Favo’s allows micro-entrepreneurs to significantly enhance their income while providing a life-changing opportunity to become economically independent – highlighting the essential role Favo's solution can play in the lives of underprivileged groups in Peru.

Entrepreneurs:

50% has no other source of income, but as a full-time job they can earn more than 50% of their household income.

Company Name:

Investment vehicle:

Labi Exames

Impact Tech I

Founded:

Year of Investment:

2017

2019

Headquarters & Global Locations:

Brazil

Website:

Impact Theme:

Social Resilience

SDGs:

(3) Good Health and Well-Being

(10) Reduced Inequalities

Founders:

Marcelo Barboza, Octavio Fernandes, Daniella Sasson and Carolina D' Alençon

Impact Vision:

A country where everyone will have easy access to affordable quality exams, increasing the chance of intercepting or curing serious diseases with adequate preventive care.

Why we invested

According to the Lancet Commission, the most outstanding issue in most health systems across pathologies and nations is the detection of conditions. Shockingly, 50% of the world’s population lacks access to diagnostic testing and in low-income countries, the number is even higher, reaching a starling 20%.

There are 160 million Brazilians without health insurance, many of whom depend entirely on the government-run public health system, which provides universal health coverage but lacks efficiency and agility of care. This often triggers significant health complications that could be avoided or mitigated with preventive exams and guidance for proper treatment at the right time. Consequences can be inconceivable, such as the 18 million diagnosed diabetics in Brazil.

Labi Exames, a clinical analysis-testing laboratory, offers affordable prices that are 40% lower than average, making quality diagnostics accessible to more people, particularly those who are vulnerable. By creating an intelligent approach to healthcare exams, Labi Exames aims to shift the focus from disease treatment to preventive care, improving the overall health of the population.

"We aim to help fight the impact of silent diseases such as diabetes that are undetected because of expensive lab testing."

Marcelo Noll Barboza

Labi's founder & CEO

“My father is elderly, he doesn’t have a health plan and doing his annual check-up is expensive, but Labi offers affordable prices.”

Patient

Impact Perfomances KPI's

Impact data: Dec/2022

4M

Exams

90k

Vaccines

836k

Total clients

54%

% price discount compared to the market average

34

Medical Clinics/Centers

86

NPS

22k

Monthly Customers

Positive Notes

Labi Exames seeks to increase access to quality healthcare for the Brazilian population. The company partnered with Rede Drogasil, one of the largest pharmacy chains in Brazil & co-investor of Labi. As a result, they established health clinics next to Drogasil pharmacies, offering integrated consultations, vaccines and laboratory tests at popular prices. The clinics focus on low-complexity care through a healthcare team of on-site nurses and remote doctors, with consultations priced at R$69.

The first two clinics served communities in remote areas from the urban center, such as the Grajaú and Brasilândia neighborhoods in São Paulo. The goal is to bring high- quality health care and use technology to offer an affordable price to a vulnerable population. It is worth noting that although Brazil's public health system (SUS) is free and universal, there is a shortage of access to exams and consultations at the proper time, decreasing the chances of preventive diagnosis and treatment.

Besides adding an imaging exam to expand the corporation's product portfolio, they are boosting the offering of low-cost healthy products, Labi Exames' commitment to providing quality service at a fair price was acknowledged as the third-best laboratory by "Reclame Aqui." This validation further supports the company's mission to improve access to quality healthcare for all.

Company Name:

Investment vehicle:

Letrus

Impact Tech I

Founded:

Year of Investment:

2014

2019

Headquarters & Global Locations:

Brazil

Website:

Letrus.com.br

Impact Theme:

Social Resilience

SDGs:

(4) Quality Education, (10) Reduced Inequalities

Founders:

Impact Vision:

A youngster population truly capable of reading & writing correctly, hence, achieving the best of their potential.

Why we invested

Unesco dissects how the capacity of proficiently writing and reading impacts someone’s life in several aspects. For instance, the unemployment rate for illiterate (26%) people is 86% larger than for literate ones (4%). Above all, there’s a direct correlation between literacy and income: literate adults earn 21.25% more than those with low-literacy levels. Individuals with low literacy levels are more likely to be unemployed or underemployed and less likely to participate in the formal labor market. This can lead to a cycle of poverty and limited economic opportunities for these individuals and their families.

In Brazil's educational scenario, 50% of all high school seniors do not have proficient reading & writing abilities and half of the college students evade their studies due to academic inability to complete their courses. According to McKinsey, education-focused technologies aim to accelerate literacy and artificial intelligence is poised to revolutionize education for future generations. Being well literate is essential for personal and professional growth, as it allows individuals to develop critical thinking and comprehension skills. Additionally, reading can be a source of personal growth and enjoyment, as it exposes one to new ideas and perspectives and allows a better understanding of the world.

The Letrus program is a cutting-edge AI platform focused on improving students' writing skills, including writing practice, structure analysis, skills analysis, writing and didactic interventions. These activities involve classroom and home-based writing assignments, using AI for immediate answers and personalized analysis, providing in-depth data, and clarifying diagnoses for students and teachers. As a result, teachers can use this feedback to create lessons that are more effective and optimize their time outside the classroom

“It is a structural problem with brutal socio-economic impact. It is hard to imagine a just society in which people cannot master their language.”

Thiago Rached

Letrus's co-founder & CEO

"I didn't think it would make much difference, but after I did the first text with Letrus, I saw that it was really good! They show you your mistakes, where you need to change, and you get to understand the structure of an essay."

Fernanda

High School Student

Impact Perfomances KPI's

Impact data: Dec/2022

44%

Public Schools (%)

174k

Total Students

645

Schools

1,3M

Reviewed Essays

73%

Current AI-Reviewed Essays (%)

Positive Notes

Letrus uses AI to correct 70% of essays, creating individualized writing profiles for students, improving their engagement and valuing the work of teachers. In 2019, a partnership between Letrus, the state Education Department of Espírito Santo, the Lemann Foundation, J-PAL/MIT & FGV enabled the implementation of the Letrus Program benefiting 12K senior high school students in 110 public schools in Espírito Santo. The impact evaluation demonstrated the effectiveness of the program and its potential to curtail by 9% the gap between students from public and private schools.

The success of the RCT research led to the program being adopted as public policy in 2022, serving as the official writing development program for every senior high school student. After four months of implementation, based on ENEM assessment criteria, students have demonstrated a 12% average improvement in their writing performance. Although data protection laws (LGPD in Brazil) prevent identification of students' demographics (such as socioeconomic status, gender, or race). School demographics can serve as a proxy for students' profiles. Currently, Letrus supports students which 93% attend either public schools or low-cost private institutions.

The COVID-19 pandemic has worsened public high school education in Brazil, with remote learning exposing the digital divide for low-income students. This shift also disrupted education and strained teachers. Today, nearly half of the schools using the Letrus solution are public schools. In order to address the internet access issue, the platform is designed for easy use with minimal computing needs and a mobile version is in development that will enable offline writing and access to the resources when online.

Recently, Letrus renewed its contract with SESI Nacional and had great success with the National Writing Contest in Pará and Paraíba. It aims to promote literacy through public education with future "Escrever Para Transformar" (Writing to Transform contest) contests, a free online cultural event.

Company Name:

Investment vehicle:

Neomed

Impact Tech I

Founded:

Year of Investment:

2016

2021

Headquarters & Global Locations:

Brazil and Chile

Website:

Neomed.com.br

Impact Theme:

Social Resilience

SDGs:

(3) Good Health and Well-Being

(10) Reduced Inequalities

Founders:

Impact Vision:

An accessible and efficient healthcare system that ensures better survival rates for patients with urgent cardiac symptoms through accurate diagnosis and appropriate treatment.

Why we invested

The World Health Organization (WHO) states Cardiac Vascular diseases (CDVs) as the leading cause of death worldwide, responsible for 17.9 million deaths – which accounts for 32% of all global deaths. It is important to mention that 38% of those passing are due to non-communicable cardiac-related pathologies. Low-income countries are disproportionately affected, accounting for 75% of deaths caused by heart disease, mainly due to a lack of access to cardiological testing and outdated healthcare technologies. As a result, there is a significant economic burden, with expenses totaling $3.7 trillion between 2011 and 2015. This represents half of the costs associated with non-communicable diseases and 2% of low and middle-income countries' gross domestic product (GDP LMICs).

Brazil has a medium-to-low density of medical talent in emergency rooms, with an even more significant deficit of cardiology specialists, particularly outside the large centers, with 60% located in the axis of the cities of Rio and São Paulo. Furthermore, only 5% of hospitals in Brazil have a cardiologist on call 24/7. The biggest challenge in successfully treating a heart attack is not the access to examination or treatment, but in the effectiveness and diagnosis timing.

Neomed's platform consolidates all necessary cardiac information. It integrates the share of medical knowledge from cardiac device manufacturers and hospitals while having an AI platform that identifies emergency cases in an average of 01:58 minutes versus the average hospitals ranging between 10 and 20 minutes. Neomed’s precise and agile technology shortened the delivery of cardiology medical reports from 5-24 days to 24h, enabling efficiency and better workflow for hospitals and health centers. Therefore, reducing costs and delivering the best available treatment, while facilitating access to quality tests for populations living on the margins of society that need a well-trained medical labor pool.

”Innovation is fundamental to generate value in healthcare. Fast, assertive, and specialized care - even in regions where doctors are lacking - improves people's quality of life.”

Gustavo Kustner

Neomed's founder & CEO

"Neomed brought hope to the region.”

Neomed user

Impact Perfomances KPI's

Impact data: Dec/2022

152

Medical Clinics/Centers

35

Hospitals using Kardia

780k

Exams Reported

88%

Public Hospitals

60k

Kardia Exams

365k

Octopus Exams

336

Years of life saved

70%

Penetration in low-income classes (C, D & E)

Positive Notes

Neomed, a newly certified B-Corporation, is making a positive impact in addressing healthcare disparities with an impressive Net Promoter Score (NPS) of 88. Their focus on serving lower-income patients (class C, D & E for Brazil) and public hospitals, which make up 70% and 88% of their patient and hospital demographics, respectively, highlights their commitment to this cause.

Neomed's latest product, Kardia, streamlines the diagnosis process for suspected heart attacks and chest pain in emergency rooms by connecting healthcare professionals and hospitals. The system includes an alert that allows hospitals to quickly identify critical diagnoses and notify medical teams, leading to early detection of potential hospitalization cases, particularly for arrhythmia. The solution was presented at the ESC Acute CardioVascular Care 2022 congress, a leading cardiovascular emergency congress.

Neomed’s impact manifests mainly through rapid EKG diagnosis times – a crucial factor in improving life expectancy and best practices in cardiovascular disease. The American Heart Association recommends a 10-minutes diagnostic window for heart attacks, but Kardia diagnoses EKGs in less than 2:00m on average.

A case study conducted over a year in a hospital utilizing Kardia demonstrated the solution reduced the average diagnosis time from 17 minutes to 1 minute and 53 seconds, resulting in a two-fold increase in pertinent hospitalization, preventing patients from being wrongly sent home. According to a study by Dr. J M Rawles, each minute in a heart attack represents a loss of 11 days in life expectancy. Based on that, Neomed calculates that Kardia has saved over 336 years of life by diagnosing EKGs much quicker than the recommended window.

Company Name:

Investment vehicle:

Occamzrazor

Legacy

Founded:

Year of Investment:

2015

2016

Headquarters & Global Locations:

United States

Website:

Occamzrazor.com

Impact Theme:

Social Resilience

SDGs:

(3) Good Health and Well-Being, (9) Industry, Innovation and Infrastructure

Founders:

Impact Vision:

A world where advanced machine learning integration accelerates scientific breakthroughs, resulting in cost-effective and highly effective treatments for complex illnesses.

Why we invested

Neurological conditions are the main cause of disability and the second leading death cause worldwide, responsible for about 10 million deaths in 2019. Besides that, 349 million years of life were lost due to neurological pathologies. Low-income countries suffer disproportionately from a lack of neurology specialists, with only 0.1 doctors per 100,000 people compared to 7.1 doctors in high-income countries.

Parkinson's disease is a growing concern in the biopharma industry, affecting 10 million people worldwide and causing significant economic losses. The cost of medications alone is around $2,500 annually and therapeutic surgery can reach $100,000 per person. A WHO study shows that 55% of global hospitals and health centers lack essential medications. For example, Levodopa/Carbidopa, a crucial medicine in treating Parkinson's Disorder, is inaccessible and expensive, with only 24.07% of African countries having such limited supplies.

OccamRazor, a digital biotech company, focuses on developing modality-agnostic treatments for convoluted brain-damaging pathologies. OccamzRazor speeds scientific research via its highly integrated machine-learning platform, where doctors and researchers can process tons of data into a multidimensional knowledge map. Therefore, the Californian-based startup supports the development of innovative drug discovery that uses digital science to map out, fully understand and finally cure brain aging pathologies, starting with Parkinson's Disease.

“I just knew I could actually make a difference. Sometimes you feel helpless. But actually, I felt deeply responsible for finding a way to get curative treatments for this disease because I knew I could do something about it.”

Katharina Sophia Volz

Occamzrazor's founder & CEO

“I’m excited to see the progress OccamzRazor has made thus far on integrating many disparate sources of data and applying machine learning towards the discovery of new candidates for fighting degenerative brain diseases.”

Jeff Dean

PhD, lead investor and the lead of Google’s AI division

Impact Perfomances KPI's

Undisclosed

Positive Notes

In 2022, OccamzRazor began work on its first paid pilot project with a major pharmaceutical company. This project focuses on developing machine learning (ML) problems that have quicker validation times than clinical trials. The company is implementing a data science and machine learning strategy to enhance the development of cell lines used to manufacture antibodies. The current process of manufacturing antibodies involves genetically modifying cells and growing them at scale, which takes approximately five months and relies heavily on trial and error. However, OccamzRazor's team seeks to shorten this timeframe through their work on this project.

Identifying the development of cell lines for antibody production as a widespread challenge in the industry, OccamzRazor has targeted an important potential market to address. Additionally, the company’s expertise in understanding and modeling complex cellular processes derived from their research on Parkinson's disease, will be applied to this new product. OccamzRazor is convinced that stacking additional projects like this one will continue further enhance their predictive capabilities across biological systems and therapeutic areas and neurodegenerative disorders.

These accomplishments underscore the company's commitment to discovering innovative solutions to real-world problems in the biopharmaceutical sector. Their focus on improving processes, leveraging their expertise and commitment to data science and machine learning position them as leaders in their field. Moreover, OccamzRazor's nomination for the prestigious Prix Galien Startup Prize, regarded as the "Oscars for biopharmaceutical research," highlights the company's achievements and growing reputation.

Company Name:

Investment vehicle:

Oya care

Impact Tech I

Founded:

Year of Investment:

2020

2022

Headquarters & Global Locations:

Brazil

Website:

Oya.care

Impact Theme:

Social Resilience

SDGs:

(3) Good Health and Well-Being (5) Gender Inequality

Founders:

Impact Vision:

All women will have access to quality female health care, autonomy over their bodies and the freedom to overcome economic and cultural barriers.

Why we invested

Despite women comprising half the population and controlling most healthcare spending worldwide, most modern medicine was designed around men's anatomy. This has led to a lack of women-specific healthcare solutions and resulted in misdiagnosis and delayed treatment for women. To address this issue, a new industry called "femtech" emerged, comprising mostly women-owned technology companies developing solutions tailored to women's unique healthcare needs. The femtech industry is expanding rapidly, with a double-digit CAGR and is projected to be worth $100 billion by 2030. This highlights the growing demand for women-specific healthcare solutions and the potential impact this industry can have on women's health.

Furthermore, 1.5 billion women did not have access to preventive care by 2021, most of whom live in low-income regions, exemplifying the discrepancy of 20 points between high-income and low-income nations on the Woman’s Health Index. In Brazil, there are 110 million women, with 65% of them under 40, most of whom are online and use their smartphones as their primary source of information. Despite the global trend toward women's healthcare disruption, options in Brazil are still analog, confusing and time-consuming. This lack of accessible and effective healthcare solutions has led to a significant proportion of Brazilian women feeling helpless regarding healthcare support, with over 60% saying they do not have the confidence to discuss their health concerns with anyone.

OyaCare, a pioneer woman-focused virtual clinic based in Brazil, seeks to democratize access to quality healthcare for the Brazilian women empowering them through preventive care and treatment, starting with two main products: Fertility Consulting, a tailored-designed program to help women construct a successful Fertile Life Plan; SOS Oya, a 24-hour virtual gynecological program that allows women to better understand their bodies and options quickly, from the convenience and privacy of their homes. The ultimate goal is to empower women to feel heard, served and better equipped to lead their lives.

"Our goal is to simplify a woman's quest for knowledge of her own body through solutions that empower decision-making with science, self-knowledge and acceptance. Knowing your body gives you more power over your choices and independence over your life.”

Stephanie Von Staa

Oya Care's founder & CEO

"Empathy, care, quick and specialized service, from the attendants on Whatsapp to the doctor who attended me, all attentive and willing to help me in everything."

Oya User

Impact Perfomances KPI's

Impact data: Dec/2022

2,3k

Sales

1,3k

Oyanas (single users)

93

NPS

39%

Clients without private health insurance

89%

SOS Oya’s capacity to solve patient’s complaints

83%

female employees in leadership positions

Positive Notes

Oya Care is a women-led company in Brazil with a predominantly female workforce committed to address the need of modern women. The company's mission is to provide simple and affordable access to information about women's bodies, often limited by cultural, socioeconomic, or prejudice issues. Focusing on data and emotional support, Oya helps women navigate their reproductive health with a sensitive, human-centered and scientific approach, helping them make informed decisions. Oya Care's starting product, "The Discovery of Fertility," seeks to tackle the taboo surrounding women's reproductive health and the barriers it creates for all women.

In 2022, Oya Care expanded its services through teleconsultation to 23 states in Brazil and 13 countries worldwide, enabling women to access specialists regardless of location. The company also offers an SOS service for fast medical care with a wait time of only 9 hours. It has made gynecological care more accessible through affordable prices and flexible payment options. Despite rapid growth, Oya Care has maintained a high customer satisfaction score of 93 (vs. the industry average of 52).

Regarding the beneficiaries served by the startup, only 39% lack health insurance, and a minority of women in Brazil would have easy access to most of the company's products and services. However, it is essential to emphasize that despite women making up half of the global population and controlling most healthcare spending, most modern medicine is designed around men's anatomy. This disregard to women's health results in misdiagnosis, delayed treatment and misinformation that affects women in all social classes.

One of Oya Care's key achievement was increasing access to knowledge about women's health. Through its digital channels and partnerships with newspapers, the company has successfully expanded its national footprint and provided valuable resources for women. By the end of 2022, Oya Care had over 47,000 subscribers across its platforms and published 123 articles on women's health and their services. The spread of information has the potential to help provide women everywhere with trusted science-based information.

Company Name:

Investment vehicle:

Pachama

Impact Tech I

Founded:

Year of Investment:

2018

2021

Headquarters & Global Locations:

United States, Canada, Mexico, Brazil, Peru, Colombia, Chile, Argentina, Ecuador, Costa Rica, Panama, Guatemala, Honduras, Indonesia and Australia

Website:

Pachama.com

Impact Theme:

Planet Prosperity

SDGs:

(13) Climate Action, (15) Life on Land

Founders:

Impact Vision:

A world that achieves net-negative carbon emissions through a transparent, well-designed and well-regulated carbon market.

Why we invested

To achieve the 1.5ºC degree climate goal established by the Paris Agreement, a 50% reduction in greenhouse gas emissions must occur by 2030 and net-zero levels must be reached by 2050. According to ECIU & Oxford Net Zero, 21% of the 2.000 largest publicly traded companies have adopted net-zero ambitions, up 20% from 2019, exponentially stimulating the demand for carbon credits.

Demand for the U$50 billion inceptive Carbon Credit industry is on the rise. However, the industry still faces challenges such as unclear regulation, limited pricing data and numerous dubious and poorly executed projects, which are hindering its contribution to the reduction of emissions.

Pachama's cutting-edge AI technology assesses the feasibility of numerous net-zero projects. It offers carbon credits generated by those projects through its marketplace in various locations like Colombia, the Amazon and Indonesia. To help alleviate the current scarcity of net-zero developments, Pachama has implemented a new project initiation feature called 'The Pachama Originals' within its ecosystem. This feature aims to increase the availability of net-zero projects and, in turn, address the shortage of carbon credits offered to the market.

“We imagined, we dreamed of a day in which we could see the impact of our technologies on helping to start new forests and helping to stop deforestation, which is happening now. It has only encouraged us to dream bigger to restore nature and solve climate change."

Diego Saez

Pachama's founder & CEO

"Regenera America is part of Mercado Libre's global ESG strategy. Each year, we will invest an amount proportional to our carbon footprint in regeneration and conservation initiatives that contribute to the fight against climate change and generate new carbon credits."

Pedro Arnt

CFO of Mercado Libre

Impact Perfomances KPI's

Impact Data: Dec/2022

2,1M

Carbon credits (booked)

6,3k

Total Hectares

Pachama Originals (2021 & 2022)

940k

Total tons of carbon to be sequestred

Pachama Originals (2021 & 2022)

1M

Planted Trees

Pachama Originals (2021 & 2022)

10,6M

Restored Trees

Pachama Originals (2021 & 2022)

Positive Notes

Pachama has been one of the most successful and prominent players in the carbon industry. Leveraging innovative technology to empower local communities, drive investment in conservation and prioritize forest conservation efforts to tackle the climate crisis. The company's efforts have earned recognition from Cleantech Group as one of the 2022 Global Cleantech 100 companies committed to taking action on climate change. In addition, the founder and CEO, Diego Saez-Gil, participated as a speaker at the World Economic Forum in Davos, which provided great opportunities for raising awareness, networking and collaboration, showcasing technology's role in environmental conservation.

Pachama has been at the forefront of the fight against climate change and continues to make significant progress in the industry. They have teamed up with Salesforce to launch the NetZero Marketplace, a platform that simplifies carbon credit purchases and promotes transparency. Another important project was the partnership with Verra, a global nonprofit organization developing and managing carbon credit standards. The project uses satellite imagery and machine learning models to estimate forest carbon storage and deforestation risk. Meanwhile, digital tools streamline data collection, analysis and validation, reducing costs and time associated with carbon credit issuance. This project will serve as a baseline for carbon offset estimation and help organizations & individuals create new carbon offset projects.

To conclude, Pachama launched the Pachama Originals to increase the offering of carbon-offset projects and their reliability. In May 2022, Pachama secured U$55M in funding from well-prestigious investors such as Future Ventures, LowerCarbon and 20VC. Pachama's success exemplifies the potential of social entrepreneurship to drive positive impact, bring together businesses and communities and offer innovative solutions to the world's pressing issues.

Company Name:

Investment vehicle:

Provi

Impact Tech I

Founded:

Year of Investment:

2018

2021

Headquarters & Global Locations:

Brazil

Website:

Impact Theme:

Social Resilience

SDGs:

(1) No Poverty, (4) Quality Education, (8) Decent Work and Economic Growth, (10) Reduced Inequalities

Founders:

Impact Vision:

A country with a diverse and skilled workforce with access to top-notch professional development, reducing disparities in quality employment for underserved populations.

Why we invested

Unemployment remains a pressing issue in Brazil, reaching 9.3% in June 2022, affecting over 10 million people. Additionally, lacking skilled professionals prevents filling 47.4% vacancies in the National Employment System (SINE). The situation is aggravated by a decrease in Real and per capita income among the working class in the past decade due to inflation, precarious labor laws and economic recession.

A significant contributor is the high level of informality in employment, with over 39 million Brazilians currently lacking formal job contracts, the highest rate since measurements began in 2015 by IBGE. High unemployment and the steep decline in earnings have led to increased poverty levels in Brazil, with 63 million living on $97/month and 33 million on $56.76/month, making social mobility difficult for future generations. Fourteen million are unemployed, with 4 million being young adults and obtaining higher education or vocational certification increases employability opportunities by 30% (IBGE &PNAD).

Provi is committed to fostering a more educated workforce by partnering with specialized schools to offer educational loans to students. These loans become more affordable through negotiations with the schools for low-interest rates. These financing opportunities are designed for students who may need access to traditional credit or cannot afford high-interest rates. Provi is making a tangible impact on social inequality.

"In Brazil, if you are a good payer, you have access to credit. If you do not have a history, they give you a high rate and little money. We realized that if we looked at a moment that changed the person's life, we could reverse this logic. And education is one of the moments of major transformation in life."

Fernando Franco

Provi's founder & CEO

“I started the course as a janitor, I left as a Data Science intern, I managed to fulfill the promise I had made to myself to enter the technology area before the pandemic ended. All this changed not only my professional life, but changed my character as well, the way I see problems and challenges. Everything became more interesting."

Dairenkon Majime, 20

Funded by Provi in a Data Science course

Impact Perfomances KPI's

Impact Data: Dec/2022

1,135k

Partners schools

R$1,129B

Financed volume

280k

Financed students

59%

Women

Data from Yunus Social Business Report regarding "VERT-Provi II Debenture II"

89%

Low-income families

Data from Yunus Social Business Report regarding "VERT-Provi II Debenture II"

50,5%

Reported an increase in income

According to a survey with 2,420 respondents after 9 months of classes financed by Provi

Positive Notes

In 2022, Provi experienced significant growth, adding 180 new partner schools, expanded course offerings and doubled its credit volume to over R$1 billion. Despite the unemployment challenge, Provi addresses the issue by connecting schools, industry and jobless students through vocational education – which is much more affordable than higher education. Germany is a successful example of promoting technical education, with 48% of high school students choosing vocational-technical schools and low youth unemployment (6.7%).

The sudden increase of the Brazilian interest rate (Selic) to 13.75% has made loans more expensive, forcing fintechs such as Provi to offer pricier services to borrowers. The financial crisis has also impacted Brazilian families, especially low-income households, reducing spending on education and essentials. This scenario required Provi to implement stricter credit criteria and decrease the risk of defaults. On the other hand, Provi established a high-impact and fair credit model where schools receive upfront tuition payments with an average discount rate of 16% and students pay full price with a 2% average interest rate per month – a very low rate compared to individual credit in Brazil without collateral.

Yunus Social Business conducted an external and independent impact report regarding the Second Issue of Simple Debentures ("VERT-Provi II Debenture II"). As of June 2022, Provi has financed 129,000 students since its existence, 59% being women and 80.9% from low-income families. They have adopted a survey on employability and income among its students in the early credit program, capturing data from 2,420 respondents nine months after classes started: 40.9% reported the same income level, 50.5% reported an increase, 6.7% reported a decrease and 1.9% lost their source of income – demonstrating the effect of Provi’s product can enhance income.

The report also highlighted the opportunity for vocational education to meet the demand for 460K tech sector jobs between 2021- 2024. As most tech professionals are male from the upper/middle class, Provi is directly promoting diversity in the tech sector by empowering the black and low-income populace through the wise use of credit. A successful example to illustrate, is the partnership with the programming school Kenzie. Provi has funded the education of over 1,500 students and and according to Provi's data, 90% of these students, after completing their course, achieved a minimum salary of R$3,000 and an average salary of around R$5,000 within 18 months, despite having no prior employment.

Finally, Provi offers programs to enhance student employment prospects, including a job-exchanging alumni network, mentorship, employer connections and job fairs. The company had 82 NPS from its student base and has contained the B Corp certification company since 2020 – reflecting its dedication to social impact and ethical practices.

Company Name:

Investment vehicle:

Slang

Impact Tech I

Founded:

Year of Investment:

2014

2020

Headquarters & Global Locations:

United States, Brazil, Colombia, Mexico, Uruguay, Chile, Costa Rica, Panama, Peru, Dominican Republic, Puerto Rico, Honduras, El Salvador, Ecuador, Bolivia, Nicaragua, Argentina

Website:

Slangapp.com

Impact Theme:

Social Resilience

SDGs:

(4) Quality Education, (8) Decent Work and Economic Growth, (10) Reduced Inequalities

Founders:

Impact Vision:

A global workforce that is fluent in English and possesses advanced, industry-specific communication skills.

Why we invested

Statista's data shows the massive adoption of the English language worldwide, with 1.5 billion speakers throughout the planet - the most prominent speaking population on Earth. Nevertheless, only 1.2% of the 422 million Latin American population can fluently speak the most business-dominant language.

On the English fluency ranking, the two largest economies in Latin America, Brazil & Mexico, ranked outside the top 10, showing a demand for English learning, especially in professional environments. In Brazil, only 5% of the population has some degree of English proficiency, while only 1% are proficient in the language for professional purposes. Forbes estimates a 35% raise in hourly wage for employees with fluent English skills and a WEF article demonstrates the relevance of language skills: German corporations that invested intensely in multilingual staff training were able to add ten export countries to their market.

A workforce fluent in English and having advanced, industry-specific communication skills is essential for businesses in today's global market. It allows effective communication and collaboration with international clients and partners, enabling companies to compete at the highest level. It also brings a diverse perspective and adaptability to the workplace, increasing productivity and innovation. Investing in employees' English proficiency and specialized communication skills can be a strategic advantage.

Slang is a digital workforce platform revolutionizing English language learning and features the most extensive offering of professional English courses. Its platform obtains 100+ highly specialized courses in various areas — from Manufacturing to Psychology. Slang’s library allows companies and universities to bring their teams beyond basic English by creating hyper-personalized career paths — right down to the job title — regardless of area, industry, or role.

"We believe that English is access to knowledge. We want to eradicate professional illiteracy. And professional illiteracy is a problem when professionals don’t have enough level of English to consume the knowledge that is online, which is massive. That is the reality of most people in Latin America. They cannot consume the knowledge that is there in English."

Diego Villegas

Slang's co-founder & CEO

“Now it is easier to understand conversations in English and reading articles and books is more accessible.”

Male user

Impact Perfomances KPI's

Impact Data: Dec/2022

31k

Monthly Students

33M

Concepts Learned

231

Courses Available

158

158

Total Customers

80%

Of users reported increased self-confidence (according to the 60db Impact Report)

58%

Reported improved work quality

(according to the 60db Impact Report)

75

Reported better access to training opportunities

(according to the 60db Impact Report)

Positive Notes

Slang was awarded as one of the most promising global 2022 Technology Pioneers by the World Economic Forum. Technology Pioneers is an integral part of the Forum’s Global Innovators community, an invitation-only group of the world’s most innovative start-ups and scale-ups at the forefront of technological and business model innovation. Past Technology Pioneers included Airbnb, Google, Kickstarter, Mozilla, Spotify, Twitter and Wikimedia.

In 2022, Slang partnered with 60 Decibles to release its first Impact Performance Report, the study found Slang obtains a powerful effect on users and high-level user satisfaction with a 64 NPS score. Despite some challenges, such as a lack of personal motivation, the report indicates a strong positive impact on Slang's users: 80% of users reported increased self-confidence, 58% reported improved work quality, 68% reported an improvement in quality of life and 75% reported better access to training opportunities.

The report also revealed Slang's impact is stronger among junior and less educated users, though they make up a small portion of the user base. This presents a growth opportunity by targeting users who experience the most significant impact.

Besides that, the Boston-based startup launched a “Culture Code”, which serves as a daily guide for Slangers on embodying their core values. The company also held its first edition of the Slang Value Awards, awarding 12 professionals for their excellence in work and high level of commitment to the Slang Values.

Company Name:

Investment vehicle:

Worc

Impact Tech I

Founded:

Year of Investment:

2019

2021

Headquarters & Global Locations:

Brazil

Website:

Worc.com

Impact Theme:

Social Resilience

SDGs:

(8) Decent Work and Economic Growth, (10) Reduced Inequalities

Founders:

Impact Vision:

An employability system with equal job opportunities across social classes with fair wages in safe workplaces.

Why we invested

The 36% unemployment rate of the low-income population, combined with the usual 14 months to be reallocated into the workforce in Brazil, exposes the systematic difficulty for those less fortunate to find fair-wage professional occupations.

Even though there are 11M establishments in Brazil, totaling a U$9.23B food-services industry, 1M of those corporations went bankrupt due to payroll issues. The sector’s problems go well beyond: the segment averages a turnover rate of 1 in 3 employees leaving their positions annually and a 3-4 weeks period to find another competent candidate. Moreover, Brazilian employment inequality is well exemplified in the city of São Paulo, where Worc contains most of its operations and the 10% richest have nine times more chances to become employed than 40% of the poorest populace. According to a BBC Brazil estimation, high income population spend an average of 30 minutes daily on job locomotion, while low-income individuals spend almost ⅓ of the day going to work.

Besides providing better management tools, such as an optimized and low-cost tool for employee payment and qualifying training for employers, Worc also offers a high-tech platform where low-income candidates can choose to apply for a variety of jobs within the food-services segment. Worc’s algorithms greatly influence the selection process, reducing hiring time to 5 days. In addition to creating a community that supports and connects workers with employers, Worc creates employment opportunities closer to their homes, reducing the negative impact of transportation and time lost.

"The food service sector has grown sustainably in recent decades, even during crises. By 2022, we see an increase of over 1,000% in the volume of jobs within Worc's platform and impact over 300,000 families."

Alex Apter

Worc's founder & CEO

"A very big differentiator of Worc are the courses and every time you complete one of those courses, your score grows and the possibility of jobs offered increases even more."

Leandro

Candidate Motique restaurant

Impact Perfomances KPI's

Impact Data: Dec/2022

633

Clients

2,3M

New opportunities generated

503k

# of people in the Worc Community

27%

Is the average potential increase in the monthly income of people who get a job through Worc’s platform

Positive Notes

In 2022, Worc made bold moves, acquiring two companies to expand its features portfolio and create new revenue streams. The first was the startup Hrestart, a digital admissions platform that covers the entire onboarding process of a new hire. This new feature can reduce the time of the admission process by 90% and help new and existing professionals transition to a new role up to five times faster than traditional onboarding. The second acquisition was Ponto Predict, a software that helps companies build more efficient scales and reduce labor costs.

One of Worc’s impacts is evaluated by the number of “generated opportunities,” it’s a match between a client (restaurant or bar) and a candidate from the Worc community that may lead to a job offer. The number of opportunities had a tremendous surge in 2022, growing 30x annually and generating more than 2 million opportunities. Additionally, Worc’s platform reduces the average time to find a job: usually, a person takes around 50 days to find a good job opportunity, but for Worc’s community, the average time is only seven days. Hence, the candidate stays unemployed for a shorter period.

But Worc’s community, which went from 133,073 to 502,719 people, has benefits beyond getting a job faster. On average, job opportunities from Worc have a 27% higher salary than jobs found through another channel. Besides that, the community can take advantage of the educational content, professional assessment and tests available to help them in future interviews. After all that, they were selected as one of the 23 most promising marketplaces in the world by Business Insider.

Company Name:

Investment vehicle:

Ruuf

Decisive Investments Fund II

Founded:

Year of Investment:

2022

2022

Headquarters & Global Locations:

Chile

Website:

Ruuf.cl

Impact Theme:

Planet Prosperity

SDGs:

(7) Affordable and Clean Energy, (13) Climate Action

Founders:

Impact Vision:

Every Latin-American-based residence can easily afford and benefit from solar energy sources through high-tech solar panels.

Why we invested

According to the World Bank, climate-related events such as extreme weather and natural disasters are having a significant economic impact in Latin America and the Caribbean, with damages estimated to be equivalent to around 1.2% of the region's GDP. Furthermore, it is projected that these events could push between 2.8 to 5.8 million people into extreme poverty.

Given that the energy sector is the largest contributor to carbon emissions in the region, transitioning to clean energy is crucial in addressing this issue. Ruuf’s product can play an important role in facilitating this transition by providing a more sustainable and efficient solution. It addresses two critical issues at once: financial affordability and limited access to residential solar energy in Latin America. The current market size is estimated at $2.2 billion, but the potential for growth is immense, with projections of up to $1.4 trillion in Latin America solely.

The Chilean startup offers a comprehensive marketplace platform where homeowners can quickly connect with solar installers. Additionally, it facilitates access to low-cost loans for financing the costs of implementing domestic solar energy. As a result, clients will have an active participation in the net zero transition while saving money on their energy expenditures.

“We want residential solar energy to become massive in our region by means of UX-friendly process, financially accessible.”

Domingo Garcia

Ruuf's founder & CEO

"70% of what we consume in Chile is imported fossil fuels and the future is going to be electric, that is the solution to curb climate change and a good part of that is going to happen in the households. Tomás gave me the five-minute pitch elevator pitch. Then I got into the details, but in general I try to make decisions based on 80/20, where the most important things are. And there was the industry, the right timing and the team."

Juan Carlos Jobet

Angel investor at Ruuf and former Chilean energy minister

Impact Perfomances KPI's

To be measured.

#

Of houses with solar energy financed by their solution

#

Of people onboard that wouldn't have access to a solar system without the Solution

#

Of $ saved by customers

#

Of CO2 emissions avoided

$

Financed by the banks

#

Of Installed Capacity (MW)

Positive Notes

Democratizing access to solar energy sources has demonstrated an important variable in the energy transition. In the United States, cheaper solar energy costs resulted in the adoption of more than 2 million solar energy systems – according to the Office of energy efficiency & renewable energy. Democratizing access to solar panels is crucial for creating a more sustainable and equitable future, reducing dependence on fossil fuels, providing energy independence, cost savings and job opportunities improving access to electricity for those in need.

Chile, Ruuf’s homeland, is one of the leading LATAM Nations in the energy transition towards a more sustainable future, intending to reach 70% renewable energy consumption and become carbon neutral by 2030 and 2050, respectively. A combination of political support and innovative green technology drives this effort. Thus, Ruff can play an essential role as a relevant player in the renewable energy sector in Latin America.

One remarkable achievement of 2022 was being selected as one of the only three Latin American startups to join the 2023 Y Combinator batch, the most prestigious startup accelerator program worldwide. As a participant, the company will have the opportunity to tap into a vast network of successful entrepreneurs, investors and mentors, which can accelerate its growth and success. The Y Combinator program has a proven track record of helping startups achieve great things, as evidenced by past participants such as Airbnb and Dropbox. Finally, they hired Pedro S (Ex-Google) as Ruuf’s CTO to improve its technology.

Company Name:

Investment vehicle:

Ten Lives

Decisive Investments Fund II

Founded:

Year of Investment:

2022

2022

Headquarters & Global Locations:

United States

Website:

Tenlives.com

Impact Theme:

Planet Prosperity

SDGs:

(9) Industry, Innovation and Infrastructure, (12) Responsible Consumption and Production, (13) Climate Action, (14) Life Bellow Water; (15) Life on Land

Founders:

Impact Vision:

A world where advanced technology enables pets to consume nutritious meals without harming the environment.

Why we invested

If Cats and Dogs, only in the US, had their nation, they would rank as the 5th largest meat consumers on the planet - they eat around 25% of all meat in the US, equivalent to Texas population.

The 33-billion-dollar Pet Food industry represents 1.9% of all land use. It is responsible for 3% of all CO2 emissions globally, corresponding to a land 2x the size of the UK and the emission of 14M vehicles, equivalent to 64 million tons of CO2.

Ten Lives’ ultra-tech solution combines machine learning with precise fermentation to produce a highly efficient carnivore-friendly protein. Therefore, Ten Lives have a significant role in diminishing the use of natural resources & greenhouse gas emissions while providing healthy and affordable nutrition solutions for the 600 million cats worldwide and their owners, expanding for other pets in the near future.

“We are making cat food with animal protein, without the animals - bringing the first sustainable, healthy cat option to the $33b cat food market. By supercharging precision fermentation with ML, we can finally produce clean, carnivore-friendly protein at cat food prices.”

Ruby Yu and Victoria Mo

Ten Live's founders

Impact Perfomances KPI's

To be measured.

#

animal lives saved

#

CO2 emissions avoided

Positive Notes

Ten Lives, founded to produce sustainable and cost-effective cat food, has achieved the first prototype of their high-precision fermentation solution enhanced by the power of Machine Learning. Currently, the main focus has shifted to developing a large-scale production strategy.

The YC-backed venture has occupied a lab space at MBC Labs, a renowned lab space. The MBC Labs facilitates early-stage biotech R&D by providing affordable prices and a world-class structure. Successful startups like Mammoth Biosciences & Ambagon Therapeutics have utilized their facilities to boost product development.

In addition, Ten Lives has partnered with a Contract manufacturing organization (CMO) that will support the startup in optimizing fermentation conditions. The company expects the first rollout to be available in the fourth quarter of this year.

Company Name:

Investment vehicle:

Rene

Decisive Investments Fund II

Founded:

Year of Investment:

2021

2022

Headquarters & Global Locations:

United States

Website:

Renee.com

Impact Theme:

Social Resilience

SDGs:

(3) Good Health and Well-Being

Founders:

Nick Desai and Renee Dua

Impact Vision:

A world where the disparity in life expectancy and access to quality healthcare between the wealthy and the marginalized is eliminated.

Why we invested

The 60yrs+ will double by 2050, representing 22% of the total global population totaling 2.2 billion people. In addition, 1 in 3 adults worldwide have a chronic disease, which is massively exacerbated by aging, as stated by the NIA: “Aging is the major risk factor for developing many major chronic diseases.”

The healthcare system is traditionally fragmented and complex and has a vast bureaucracy that increases the cost for providers of care, medications, etc. These challenges make it difficult for most people to access quality health care, especially among the most vulnerable. The American Geriatrics Society estimates 30% of the +65yr population (16.8MM) need a geriatrician and/or individualized professional care, combined with the fact the United States will experience a 21.6% elder population growth. Therefore, an easy-to-spread solution must be developed to assist this underserved community.

Renee is a customer-centric health assistant that helps each patient integrate, unify and deliver a unique combination of providers and services for their needs, supporting them in their prevention and treatment journey from scheduling lab exams to finding urgent care. Renee sources these providers worldwide to find the best prices to make quality healthcare affordable to everyone everywhere. Therefore, Renee has been bridging the gap between geriatricians and providing a unique solution to an underserved population.

"Renee is a personal healthcare assistant that unifies the myriad complex aspects of healthcare into one intuitive, delightful experience specifically designed for underprivileged, older Americans who often have lower health and tech literacy and multiple health, social and cultural factors that require coordinated attention to realize improved outcomes.”

Nick Desai

Renee's co-founder & CEO

Impact Perfomances KPI's

To be measured.

#

$ saved by clients

%

Health-related problems solved

%

Service price versus market average

%

Clients that improved vital signs

%

Clients health literacy improvement

Positive Notes

Renee intends to launch the first Open AI-based consumer healthcare app on March 2023. The leading-edge technology will be able to identify the complete health profile of patients just by a simple prescription bottle.

Reene’s avant-garde product allows the 53M American caregivers and the 100M with at least two chronic diseases to stay upfront on crucial medical duties. According to the company's data, Renee has shown to improve blood pressure by 17% in 90 days. That single improvement alone can increase life expectancy 2 to 5 years on the average person.

The first product produced promising results, a 94 NPS with 91% of patients engaging 5.4x weekly with the application, decreased systolic blood pressure by 25.5mm in hypertensive patients.

Company Name:

Investment vehicle:

Apprenty

Decisive Investments Fund II

Founded:

Year of Investment:

2022

2022

Headquarters & Global Locations:

Brazil

Website:

Apprenty.com.br

Impact Theme:

Social Resilience

SDGs:

(4) Quality Education, (8) Decent Work & Economic Growth

Founders:

Impact Vision:

A country with equitable access to top-tier education that prepares all citizens, especially the youth and vulnerable, for the demands of the future workforce, resulting in a stronger economy.

Why we invested

In 2021, Brazil had one of the highest rates of youth unemployment in Latin America, with 31.9% of individuals between the ages of 15 and 24 being inactive. A significant contributing factor to this high rate of joblessness among young people is the lack of a solid vocational education system, with only 8% of Brazilians pursuing vocational paths. In contrast, countries such as Germany and Switzerland have implemented successful vocational education programs for young adults and teenagers, resulting in an adoption rate of 66.6%. Furthermore, studies have shown that vocational education leads to an increase in earnings, with students in the Netherlands experiencing a rise of 3.3% to 15.3%.

The Jovem Aprendiz Program was created in 2000 to create job opportunities for youngsters between 14-24. It obligates medium and big companies to have 5% of their workforce as apprentices. Although there are 436K young workers on this program, there is a firing rate of 90% as well as a high informality number where apprentices are not registered. On top of that, some companies consider this program such a struggle they prefer to pay fees instead of incorporate apprentices inside the company’s operations due to extensive bureaucracy & low return rates from bad-qualified apprentices – as stated by the president of Proa, one the largest educational-oriented NGOs in Brazil.

Apprenty is preparing the next generation of Brazilian workers by bridging the gap between highly motivated young individuals and tech-enabling courses while profoundly comprehending large corporations' most in-demand corporate skills. To disrupt the vocational education in Brazil and boost employability and quality, Apprenty aims to revolutionize the apprenticeship model – a system for training a new generation of practitioners of a trade or profession with on-the-job training and often some accompanying study. By transforming the program into a highly effective method for training individuals, Apprenty seeks to enhance human capital and increase productivity, thereby creating numerous new job opportunities for the youth population.

"Despite having taken several courses and always looking to develop myself, I couldn't find a job. Apprenty changed that! I'm going to work at a company I really admire and I will get there much more prepared for the challenges I may encounter."

Guilherme Antunes

Apprenty's co-founder & CEO

"At apprenty, we envision a world where a comprehensive Education System, including alternate routes to employment such as vocational training and apprenticeships, enables people - all people - to discover their own definition of success and then develop the skills needed to achieve it, building prosperous careers and becoming outstanding professionals. After all, talent is born everywhere, but opportunity is not.”

Maria Eduarda Hais

Apprentice

Impact Perfomances KPI's

To be measured.

#

Of graduate apprentices

%

Graduate apprentices’ job retention rate

%

Of apprentices that were hired in a formal job after the Jovem Aprendiz program

%

Increase in monthly income

Positive Notes

Apprenty’s methodology is unique, because it offers a project-based immersion with plenty of case studies, live classes and individualized mentorship. Moreover, Apprenty Community helps students exchange professional experiences, promotes collective learning and exclusive sessions for members of its community.

Apprenty had an exciting first year; they raised a pre-seed round, established partnerships with leading educational institutions such as Alura and Inteli and tested a pilot class of apprentices. Most of them were hired by big companies like Creditas, Stone and Citi, as well as some well-known startups – the MVP was essential for generating valuable insights and comprehending companies' set-skill requirements.

This year, the company plans to strengthen the team to enable business growth, particularly in the tech team. Moreover, the Edtech has two main goals: Execute a complete test of the apprentice program, with a significant emphasis on hiring its young employees base at the end of their contract; secondly, obtain governmental authorization to become a certified Technical School.

Ilustration set by Bárbara Bucker

Layout & design by Mari Sarli